As the price of bitcoin has increased in the past few weeks there has been a plenty of talk about it being speculation-driven, often with reference to a huge crash since bitcoin's adoption and usage is not necessarily keeping pace with the increase in price.

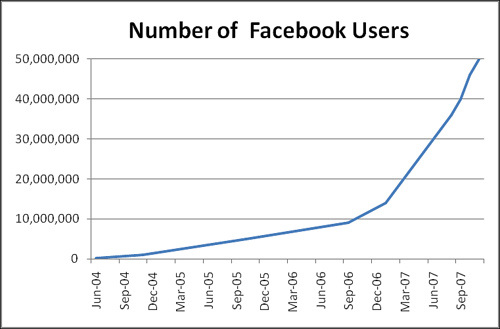

However adoption, coverage, price, speculation and usage do not each exist in a vacuum. They are interrelated and will feed each other; an increase in adoption will bolster media coverage which will bolster speculation and price, an increase in price will increase coverage which may encourage further adoption and speculation. This cycle is not negative - it is part of bitcoin's growth and its path to the mainstream with adoption (actual usage of bitcoin) being the demand underpinning its value. Whether we are in a huge bubble right now is whether we are seeing pure short term speculation vs actual adoption. This depends to some extent on the psychology of the adopters and whether they see long term value in bitcoin.

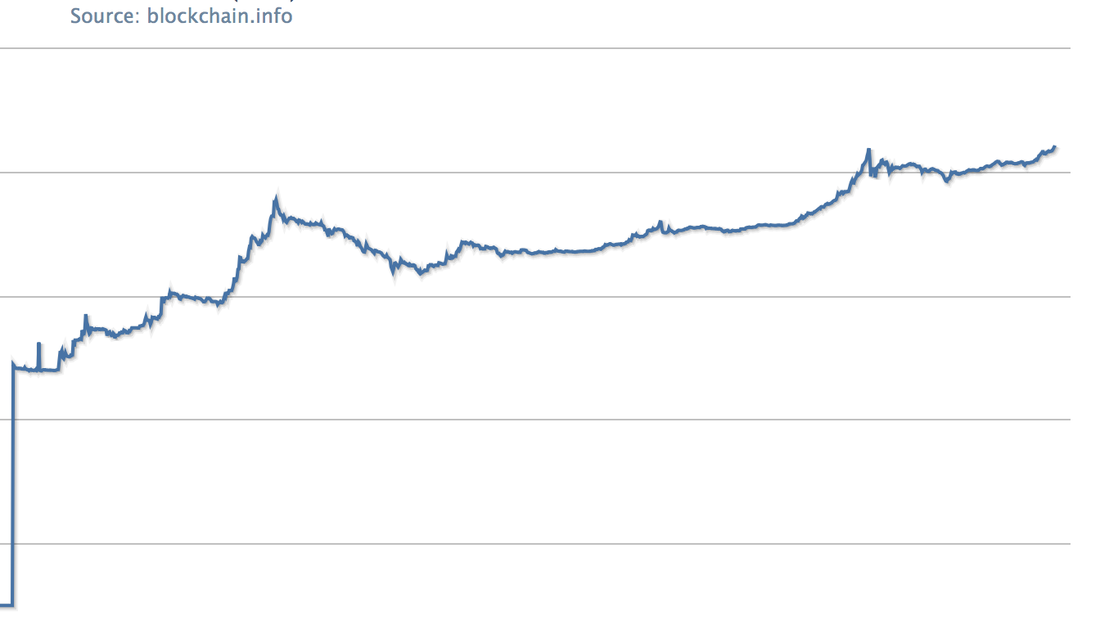

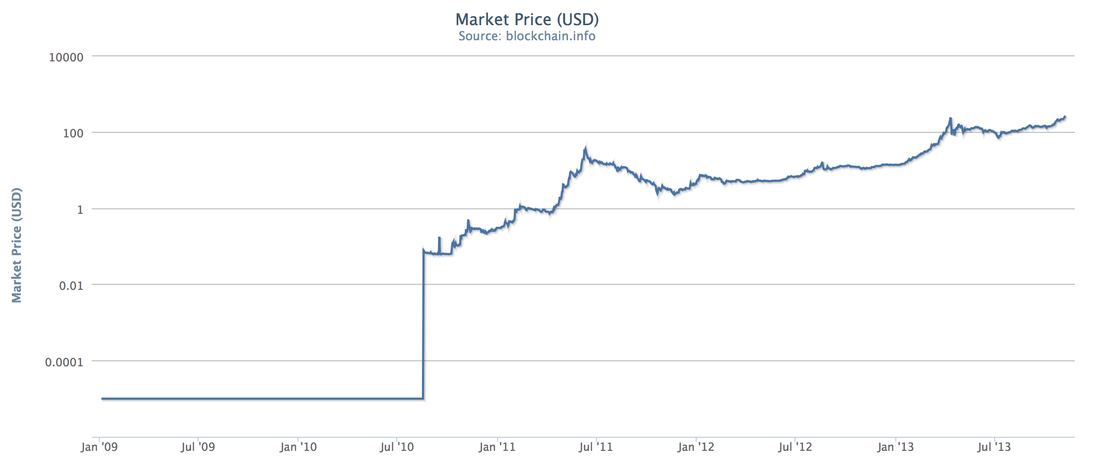

The more small-scale drops and crashes bitcoin recovers from the more adopters will feel comfortable in holding onto their bitcoins during a drop rather than cashing out and accelerating the fall. Further as more early adopters cash out to buy houses and such there will be fewer fat-fingered sells that cause large downward spikes in the exchanges to trigger these sell offs. It is worth pointing out that the recent drop from around $820 (MtGox) halted at $500, still higher than any previous value before the climb, and was quickly reversed, climbing back up to around $800:

However adoption, coverage, price, speculation and usage do not each exist in a vacuum. They are interrelated and will feed each other; an increase in adoption will bolster media coverage which will bolster speculation and price, an increase in price will increase coverage which may encourage further adoption and speculation. This cycle is not negative - it is part of bitcoin's growth and its path to the mainstream with adoption (actual usage of bitcoin) being the demand underpinning its value. Whether we are in a huge bubble right now is whether we are seeing pure short term speculation vs actual adoption. This depends to some extent on the psychology of the adopters and whether they see long term value in bitcoin.

The more small-scale drops and crashes bitcoin recovers from the more adopters will feel comfortable in holding onto their bitcoins during a drop rather than cashing out and accelerating the fall. Further as more early adopters cash out to buy houses and such there will be fewer fat-fingered sells that cause large downward spikes in the exchanges to trigger these sell offs. It is worth pointing out that the recent drop from around $820 (MtGox) halted at $500, still higher than any previous value before the climb, and was quickly reversed, climbing back up to around $800:

Store of Value Counts as adoption

Bitcoin has the potential to make some major changes to the payments and remittances industry amongst many others and as its adoption in this space increases we can treat this as a fundamental driver of its increase in value. If thousands of people use it daily to send money from one country to another then they need to own bitcoins to do this and this creates demand which drives up its price.

But velocity (how long those bitcoins are held before they are sent on to take part in another transaction) is a key factor in this and one form of adoption that is often left out is as a store of value.

Anyone storing some portion of their wealth long term in bitcoin is actively using that number of bitcoins even if they are not transferring them. They are using them as a store of value and contributing to demand which is every bit as valid as using them to send value around the world. Despite the usual 'intrinsic value' claims much of gold's value comes from demand to use it as an inflation-resistent and well accepted store of value.

But velocity (how long those bitcoins are held before they are sent on to take part in another transaction) is a key factor in this and one form of adoption that is often left out is as a store of value.

Anyone storing some portion of their wealth long term in bitcoin is actively using that number of bitcoins even if they are not transferring them. They are using them as a store of value and contributing to demand which is every bit as valid as using them to send value around the world. Despite the usual 'intrinsic value' claims much of gold's value comes from demand to use it as an inflation-resistent and well accepted store of value.

Bitcoins price can justifiably sit well above its fundamental value today

Demand from the various uses of bitcoin makes up its fundamental value. Anything over that is speculation: perceived future value which has been taken into account now and has pushed the price up in anticipation that its fundamental value will increase in the future.

Clearly there is some speculation in bitcoin and some would argue that today it makes up a significant portion of its value however this does not necessarily mean it is overbought and bound to crash to a far lower price.

If people believe that a bitcoin may be worth $10,000 in a couple of years then they are likely to be ready to pay $1,000 for one today. If we factor risk into that equation then it changes the price they will pay; the more confident they are that it will rise to $10k the more they will be willing to pay today since they are more sure of the return.

As I have said this isn't any different to how the stock market operates. Companies don't sell for their exact value today, they sell for a price based on their value today plus expected future gains - this is why we have P/E ratios. Given this then, if adoption is increasing and more investors can see the writing on the wall for companies like Western Union it is not unreasonable to predict that bitcoin's fundamental value will increase very significantly over the coming few years. At this point a speculator becomes more confident of the return that they can get (bitcoin's price rising as a result of adoption demand) and they buy. This doesn't necessarily mean they create a bubble, but it means it brings forward the price increase - the value increases are realised earlier and more quickly while speculators wait in expectation that the fundamental value will increase.

Over time these speculators (if they are correct) see the fundamental value increase past a level they predict and they cash out in the belief that they won't get further significant returns: that any future increases will be purely driven by (incorrect) speculation or will be small enough such that they will not produce an acceptable return. Since speculators are human things are never going to be as simple and smooth as this. They might get excited and bid the price up beyond what they can rationally justify or get worried when they see a fall in the price and cash out early accelerating it but overall the trend will be that the increase in value will be brought forward. If everyone is confident that demand will increase ten fold in the next 12 months then we shouldn't expect to see the price increase steadily in step with that increase in adoption, we should expect to see it increase earlier as speculators buy in, maybe overshoot somewhat and eventually settle at a price which is closer to the future fundamental value.

How closely the value follows adoption or, conversely, how quickly the price today incorporates predicted increases in value will be a function of investor confidence, as will the volatility on the way there.

Clearly there is some speculation in bitcoin and some would argue that today it makes up a significant portion of its value however this does not necessarily mean it is overbought and bound to crash to a far lower price.

If people believe that a bitcoin may be worth $10,000 in a couple of years then they are likely to be ready to pay $1,000 for one today. If we factor risk into that equation then it changes the price they will pay; the more confident they are that it will rise to $10k the more they will be willing to pay today since they are more sure of the return.

As I have said this isn't any different to how the stock market operates. Companies don't sell for their exact value today, they sell for a price based on their value today plus expected future gains - this is why we have P/E ratios. Given this then, if adoption is increasing and more investors can see the writing on the wall for companies like Western Union it is not unreasonable to predict that bitcoin's fundamental value will increase very significantly over the coming few years. At this point a speculator becomes more confident of the return that they can get (bitcoin's price rising as a result of adoption demand) and they buy. This doesn't necessarily mean they create a bubble, but it means it brings forward the price increase - the value increases are realised earlier and more quickly while speculators wait in expectation that the fundamental value will increase.

Over time these speculators (if they are correct) see the fundamental value increase past a level they predict and they cash out in the belief that they won't get further significant returns: that any future increases will be purely driven by (incorrect) speculation or will be small enough such that they will not produce an acceptable return. Since speculators are human things are never going to be as simple and smooth as this. They might get excited and bid the price up beyond what they can rationally justify or get worried when they see a fall in the price and cash out early accelerating it but overall the trend will be that the increase in value will be brought forward. If everyone is confident that demand will increase ten fold in the next 12 months then we shouldn't expect to see the price increase steadily in step with that increase in adoption, we should expect to see it increase earlier as speculators buy in, maybe overshoot somewhat and eventually settle at a price which is closer to the future fundamental value.

How closely the value follows adoption or, conversely, how quickly the price today incorporates predicted increases in value will be a function of investor confidence, as will the volatility on the way there.

RSS Feed

RSS Feed