Bitcoins used to transfer $700bn a year in remittances around the world, store $2,600bn in value in place of the precious metals market, process $1,800bn in internet payments and $1,000bn in mobile payments. 6.1 trillion dollars of value in total, giving Bitcoin a fully justified market cap of five billion dollars.

There's a reason the above statement doesn't make sense. As of today bitcoin isn't at the point of handling any of those jobs at the scale quoted. If it were, it would be impossible for it to do so with a market cap anything like it has today - around $5bn or $400 per bitcoin.

Today, many can see the potential for bitcoin in the future, but a question that often gets asked is when will this potential become manifest and lead to an increased price for bitcoin.

There's a reason the above statement doesn't make sense. As of today bitcoin isn't at the point of handling any of those jobs at the scale quoted. If it were, it would be impossible for it to do so with a market cap anything like it has today - around $5bn or $400 per bitcoin.

Today, many can see the potential for bitcoin in the future, but a question that often gets asked is when will this potential become manifest and lead to an increased price for bitcoin.

Supply and Demand

Alibaba (BABA) recently IPO'd with an annual revenue of $8.65bn (projected from 9 months) leading to a market cap of $225bn (26x its revenues). This isn't a close analogy for bitcoin since bitcoin isn't a company, doesn't have revenues or profits, and doesn't have the capacity to create new products to diversify into new areas in the future and bring in more money.

What it does illustrate though is that BABA's worth isn't just based on today's value, its based on its value in the future. People buy BABA shares because they think they will be worth more in the future. If someone were to assess BABA's value purely based on its cash holdings or one years revenue then the price they would pay would be much lower than the current share price. Those people, if they exist, don't own BABA shares because there are other people willing to pay a lot more than them. They have been priced out by people that see the future value of BABA. This new group believes the value of BABA shares to be worth more so they are willing to pay more, meaning the price of BABA shares goes up, and the market cap is 26x revenue instead of 1x. The new group owns BABA shares because they want them more than the first group, and they pay a higher price for the same reason.

BABA's price is set by simple supply and demand. Volatility around the price will be created by people trying to trade short term fluctuations and make money from them but the bulk of the value is created by the demand from people that want to own BABA shares.

In the same way, bitcoin's price increases were fuelled by demand. People around the world wanted to own and hold onto bitcoin for whatever reason, and the price seemed OK, so they bought. As they bought there was no more seller at that particular price so the next buyer had to pay a little more to get their bitcoins. This is the process you can observe on any exchange in the world.

Scale this process up and you have an ongoing price rise. Add into it the fact that sellers can see the price going up visibly and can decide to move their sale price up based on their future projections and you have an exponentially rising price. Add into that new buyers seeing and reading about the exponential gains that they would like to be a part of and you have a bubble where the price gains in multiples then collapses after people think its gone too far, to bounce back to a new (much higher) plateau of calm.

This is the process we have seen before for bitcoin and if bitcoin continues to grow and become adopted we will likely see it again.

What it does illustrate though is that BABA's worth isn't just based on today's value, its based on its value in the future. People buy BABA shares because they think they will be worth more in the future. If someone were to assess BABA's value purely based on its cash holdings or one years revenue then the price they would pay would be much lower than the current share price. Those people, if they exist, don't own BABA shares because there are other people willing to pay a lot more than them. They have been priced out by people that see the future value of BABA. This new group believes the value of BABA shares to be worth more so they are willing to pay more, meaning the price of BABA shares goes up, and the market cap is 26x revenue instead of 1x. The new group owns BABA shares because they want them more than the first group, and they pay a higher price for the same reason.

BABA's price is set by simple supply and demand. Volatility around the price will be created by people trying to trade short term fluctuations and make money from them but the bulk of the value is created by the demand from people that want to own BABA shares.

In the same way, bitcoin's price increases were fuelled by demand. People around the world wanted to own and hold onto bitcoin for whatever reason, and the price seemed OK, so they bought. As they bought there was no more seller at that particular price so the next buyer had to pay a little more to get their bitcoins. This is the process you can observe on any exchange in the world.

Scale this process up and you have an ongoing price rise. Add into it the fact that sellers can see the price going up visibly and can decide to move their sale price up based on their future projections and you have an exponentially rising price. Add into that new buyers seeing and reading about the exponential gains that they would like to be a part of and you have a bubble where the price gains in multiples then collapses after people think its gone too far, to bounce back to a new (much higher) plateau of calm.

This is the process we have seen before for bitcoin and if bitcoin continues to grow and become adopted we will likely see it again.

Bitcoin's Growth Chart

Below is a price chart in logarithmic scale for the duration of bitcoin's existence. So far it follows what looks like a choppy linear line in logarithmic scale which means so far it has been growing exponentially albeit with a lot of volatility:

The three lines here are roughly the highest peak, the two most recent peaks and the troughs of bitcoin's price over time projected forward into the next few years.

If you're a believer in this chart then maybe the chart will make a new trough over the next few months keeping bitcoin around $400 but a rise looks to be on the cards soon, likely before the end of the year, increasingly likely into 2015. When the rise does come again if you buy into this charts predictive capacity then you are looking at a new high of $10k+, maybe settling to a new plateau in the range of mid thousands per bitcoin.

Thats if you buy into this chart and its capacity to predict. If you had bought into that when bitcoin was at $100 you would have multiplied your money buy now so it may pan out just the same again but its hard to infer much from just one chart. When it comes down to it, the chart isn't determining bitcoin's price, it is following it.

If you're a believer in this chart then maybe the chart will make a new trough over the next few months keeping bitcoin around $400 but a rise looks to be on the cards soon, likely before the end of the year, increasingly likely into 2015. When the rise does come again if you buy into this charts predictive capacity then you are looking at a new high of $10k+, maybe settling to a new plateau in the range of mid thousands per bitcoin.

Thats if you buy into this chart and its capacity to predict. If you had bought into that when bitcoin was at $100 you would have multiplied your money buy now so it may pan out just the same again but its hard to infer much from just one chart. When it comes down to it, the chart isn't determining bitcoin's price, it is following it.

the MtGox Willy Bot

Bitcoin's previous rises may not be quite so simple as all this though. After the collapse of MtGox data has surfaced which shows activity inside MtGox around the big price rise to $1200/btc. The Willy Report (link) appears to show that bots inside MtGox were responsible for a lot of buying activity which drove the recent big price rise for bitcoin.

I'm not going to get into the ethics of what happened around MtGox here or the likelihood of it being an inside job but the fact is that the bots were buying bitcoins from real users owning real bitcoins. They may have been using money that wasn't theirs such that eventually the whole show collapsed and left a lot of people unexpectedly out of pocket but it was nevertheless a process that occurred.

The bots created demand, whether fuelled by their own money or unethically with someone elses, and this created a price rise. This price rise was likely multiplied by real people jumping on the bandwagon to buy but the net result was a lot of demand so a very large price rise which overinflated, popped then settled.

Whether the bots were 'fake demand' and therefore this new price is meaningless and a fall to a level before these events is justified now depends on who is holding all those bitcoins now. Are they keen to dump them on the market thereby increasing supply and driving the price down? I would say at this point that isn't the case. The price has had some volatility and has fallen from the $1200 peak but we seem to be roughly settled on a new (higher) price plateau for now.

The bots stoked the price rises by creating and encouraging demand but their existence hasn't collapsed confidence that bitcoins are valuable.

I'm not going to get into the ethics of what happened around MtGox here or the likelihood of it being an inside job but the fact is that the bots were buying bitcoins from real users owning real bitcoins. They may have been using money that wasn't theirs such that eventually the whole show collapsed and left a lot of people unexpectedly out of pocket but it was nevertheless a process that occurred.

The bots created demand, whether fuelled by their own money or unethically with someone elses, and this created a price rise. This price rise was likely multiplied by real people jumping on the bandwagon to buy but the net result was a lot of demand so a very large price rise which overinflated, popped then settled.

Whether the bots were 'fake demand' and therefore this new price is meaningless and a fall to a level before these events is justified now depends on who is holding all those bitcoins now. Are they keen to dump them on the market thereby increasing supply and driving the price down? I would say at this point that isn't the case. The price has had some volatility and has fallen from the $1200 peak but we seem to be roughly settled on a new (higher) price plateau for now.

The bots stoked the price rises by creating and encouraging demand but their existence hasn't collapsed confidence that bitcoins are valuable.

New Demand

So if we are at a plateau now and the Willy bot revelations aren't collapsing the price what can now push the price up to create further growth in bitcoin's price? Again the answer can only be demand, more of it.

Estimates put the MtGox bots at having bought around 270,000 bitcoins. At todays prices this works out around $112m but that wouldn't have been the actual spend since much of the buying would be at lower levels. What we can say though is that this sustained buying of 270,000 bitcoins may have created the price jump. The purchase of these 270,000 bitcoins alone may not have had enough effect to move the price up so high but they created a sustained increase in price which drew in further demand.

If we are looking at what might create another price rise we need to be considering demand of the same order or larger.

Estimates put the MtGox bots at having bought around 270,000 bitcoins. At todays prices this works out around $112m but that wouldn't have been the actual spend since much of the buying would be at lower levels. What we can say though is that this sustained buying of 270,000 bitcoins may have created the price jump. The purchase of these 270,000 bitcoins alone may not have had enough effect to move the price up so high but they created a sustained increase in price which drew in further demand.

If we are looking at what might create another price rise we need to be considering demand of the same order or larger.

Vs Supply

The Willy bot info can potentially be seen as an opportunity to quantify the cost of a significant price rise in bitcoin but it is also worth looking at the other side of the coin - supply.

Bitcoin produces one block every 10 minutes so 144 blocks per day. The current block reward is 25btc which means a total supply of 3600btc per day or 1.3 million btc per year. This sounds like a lot and if all of it were dumped on the exchanges every day it likely would be but there is no evidence that this is the case and miner are unlikely to be so stupid. Instead they, more than other users, likely see the long term value of bitcoin (since they have invested so heavily into it) and will likely hold their bitcoin.

However it does also give us a useful base case, if 1.3 million btc were purchased inside a year then the probability is this would push up the price significantly since, barring a very large holder liquidating, it would almost certainly far outstrip the supply of bitcoin for sale during that year.

This reward will also halve likely some time in 2017 meaning greatly reduced supply around that time and possibly encouraging those with a desire to hold bitcoin to get in before then.

Bitcoin produces one block every 10 minutes so 144 blocks per day. The current block reward is 25btc which means a total supply of 3600btc per day or 1.3 million btc per year. This sounds like a lot and if all of it were dumped on the exchanges every day it likely would be but there is no evidence that this is the case and miner are unlikely to be so stupid. Instead they, more than other users, likely see the long term value of bitcoin (since they have invested so heavily into it) and will likely hold their bitcoin.

However it does also give us a useful base case, if 1.3 million btc were purchased inside a year then the probability is this would push up the price significantly since, barring a very large holder liquidating, it would almost certainly far outstrip the supply of bitcoin for sale during that year.

This reward will also halve likely some time in 2017 meaning greatly reduced supply around that time and possibly encouraging those with a desire to hold bitcoin to get in before then.

A Bounded Estimate

For a large price rise then in the order of what we have seen previously that might fit our original graph, we are likely looking for demand in the region of 270,000 to 1,300,000 bitcoins inside one year which at current prices roughly translates into $108m to $520m.

The Majority

Early adopters are now in bitcoin and are likely holding it until they see major price rises, at which point they may cash out or liquidate a portion of their holdings.

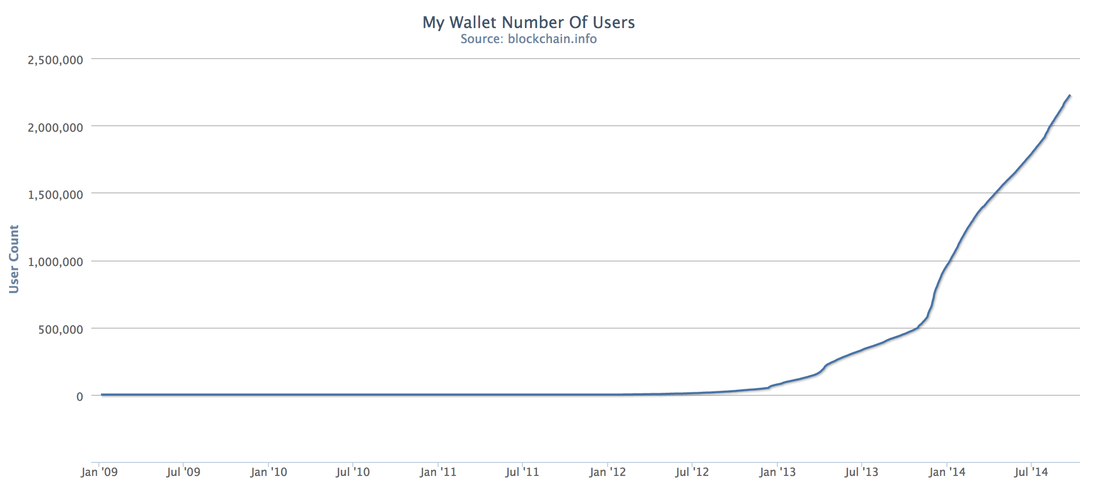

Bitcoin has had a lot of press at this point and a lot of technical people already know what it is and have decided to buy in or not but we are still seeing growth. Blockchain reports user wallets as having grown from around 1m in Jan to 2.2m now. This is a steady and significant increase which over time appears to show (choppy) exponential growth.

Bitcoin has had a lot of press at this point and a lot of technical people already know what it is and have decided to buy in or not but we are still seeing growth. Blockchain reports user wallets as having grown from around 1m in Jan to 2.2m now. This is a steady and significant increase which over time appears to show (choppy) exponential growth.

Note that the price rise late last year created an increase in adoption which appears to have sustained throughout 2014.

Although Blockchain.info represents only a portion of bitcoin users around the world it is a popular service and we can reasonably posit that bitcoin's userbase is likely in the low millions of users, maybe tens of millions.

Looking at how far bitcoin could go from here, there may be 7 billion people on earth but many of them aren't in a position to own bitcoin and possibly even don't have access to the internet. A better metric would be smartphone users around the world which in 2014 will total 1.75bn.

If we assume around 1-10m bitcoin users right now this leaves room for an increase in the user base of 175x to 1750x. Exactly what this would translate to in terms of dollar demand isn't clear since we don't know how many of these people will be reached, when, how many bitcoin they will own and what they will need to pay for each bitcoin but we can say there is plenty of room for growth by further adoption.

Blockchain.info for 2014 appears to show pretty linear growth which, if we extrapolate it, looks like it might point to an increase in bitcoin adoption of 2x current levels in a year or so. If we assume the rest of bitcoin is being adopted at roughly the same rate and go back to an estimate of 1-10m bitcoin users then this would translate to an additional 1-10m users by mid-late 2015.

If we make a conservative estimate of 2m bitcoin users today then to fuel another 270,000 bitcoin buying streak these users would need to purchase 0.135 bitcoins each, or roughly $54 worth of bitcoin each at current prices.

If we assume the need for a larger buying streak of 1.3m bitcoins equal to a years worth of mining output then then this works out around 0.65 bitcoins per new user or $260.

There are assumptions in here but the trend points toward increasing adoption. The user counts may be some distance out but it seems possible that simple organic growing adoption could fuel a significant price rise (if not a massive one) within the next 12 months.

Although Blockchain.info represents only a portion of bitcoin users around the world it is a popular service and we can reasonably posit that bitcoin's userbase is likely in the low millions of users, maybe tens of millions.

Looking at how far bitcoin could go from here, there may be 7 billion people on earth but many of them aren't in a position to own bitcoin and possibly even don't have access to the internet. A better metric would be smartphone users around the world which in 2014 will total 1.75bn.

If we assume around 1-10m bitcoin users right now this leaves room for an increase in the user base of 175x to 1750x. Exactly what this would translate to in terms of dollar demand isn't clear since we don't know how many of these people will be reached, when, how many bitcoin they will own and what they will need to pay for each bitcoin but we can say there is plenty of room for growth by further adoption.

Blockchain.info for 2014 appears to show pretty linear growth which, if we extrapolate it, looks like it might point to an increase in bitcoin adoption of 2x current levels in a year or so. If we assume the rest of bitcoin is being adopted at roughly the same rate and go back to an estimate of 1-10m bitcoin users then this would translate to an additional 1-10m users by mid-late 2015.

If we make a conservative estimate of 2m bitcoin users today then to fuel another 270,000 bitcoin buying streak these users would need to purchase 0.135 bitcoins each, or roughly $54 worth of bitcoin each at current prices.

If we assume the need for a larger buying streak of 1.3m bitcoins equal to a years worth of mining output then then this works out around 0.65 bitcoins per new user or $260.

There are assumptions in here but the trend points toward increasing adoption. The user counts may be some distance out but it seems possible that simple organic growing adoption could fuel a significant price rise (if not a massive one) within the next 12 months.

Bitcoin Businesses

One important source of demand related to bitcoin growth and adoption outside of consumers are the businesses that serve them.

Investment in bitcoin companies has been growing significantly $188m invested so far in 2014 versus just $91m in the whole of 2013. Extrapolated this would work out roughly at $250m in 2014 and, if the increase trend continues, in 2015 likely something in the range of $410m to $695m.

In 2014 so far a large chunk of this investment went to wallet startups. Generally wallet startups won't need to hold a lot of bitcoin since they are holding it on behalf of their users. They may help adoption and in some cases facilitate bitcoin buying but the investment money won't go into bitcoin.

Of the remainder around 20% went into payment processors, 22% went into financial services, 20% went into exchanges and 15% went into 'universal' companies.

Exchanges here likely have the most clear need to hold actual bitcoin (rather than facilitate others) and no doubt some of their invested funds will go towards buying bitcoin to create a market and fund a hot wallet. However, even if the full total of the money invested went into buying bitcoin (clearly it wouldn't) then this would still only equate to $37m-$50m, some way short of the bounded estimate required for a significant price increase. The far more likely case is only a fraction of their investment would be used to purchased bitcoin which would drop this well below the demand required.

Although bitcoin companies will help push bitcoin adoption, they so far don't look to be a likely candidate for the source of demand required for the next big price increase except through continued adoption.

Investment in bitcoin companies has been growing significantly $188m invested so far in 2014 versus just $91m in the whole of 2013. Extrapolated this would work out roughly at $250m in 2014 and, if the increase trend continues, in 2015 likely something in the range of $410m to $695m.

In 2014 so far a large chunk of this investment went to wallet startups. Generally wallet startups won't need to hold a lot of bitcoin since they are holding it on behalf of their users. They may help adoption and in some cases facilitate bitcoin buying but the investment money won't go into bitcoin.

Of the remainder around 20% went into payment processors, 22% went into financial services, 20% went into exchanges and 15% went into 'universal' companies.

Exchanges here likely have the most clear need to hold actual bitcoin (rather than facilitate others) and no doubt some of their invested funds will go towards buying bitcoin to create a market and fund a hot wallet. However, even if the full total of the money invested went into buying bitcoin (clearly it wouldn't) then this would still only equate to $37m-$50m, some way short of the bounded estimate required for a significant price increase. The far more likely case is only a fraction of their investment would be used to purchased bitcoin which would drop this well below the demand required.

Although bitcoin companies will help push bitcoin adoption, they so far don't look to be a likely candidate for the source of demand required for the next big price increase except through continued adoption.

The FBI Sale, Demonstrable Large Demand

The FBI's auction of the Silk Road bitcoins amounted to around 30,000 bitcoins (then around $18m) in total but also due to a leak gave a very useful window into future sources of large scale bitcoin demand.

Perhaps around 14 of the total 17 listed bidders are investment companies or large scale investors buying bitcoin not on behalf of consumers purchasing it from them. However there were in total around 40 names on the list. This would indicate that each of these were interested in buying between 3000 and 29696 bitcoins.

If we extrapolate the number to the full list we end up with 33 bidders that likely are bidding on their own behalf. If each of these 33 were planning on buying the full set and holding it alongside normal bitcoin holders this equates to $594m of demand or 990,000 bitcoins. At a minimum if each were interested only in one block of 3000 bitcoin this would work out at $59m or 99,000 bitcoins.

My tendency would be to put the estimate of this demand closer to the upper rather than the lower given the scale of the bidders involved (the Winklevoss twins purchased 1 million bitcoin in order to fund their ETF so we can likely expect that institutional investors are aiming to purchase a mere 3,000 for just $1.8m).

Perhaps around 14 of the total 17 listed bidders are investment companies or large scale investors buying bitcoin not on behalf of consumers purchasing it from them. However there were in total around 40 names on the list. This would indicate that each of these were interested in buying between 3000 and 29696 bitcoins.

If we extrapolate the number to the full list we end up with 33 bidders that likely are bidding on their own behalf. If each of these 33 were planning on buying the full set and holding it alongside normal bitcoin holders this equates to $594m of demand or 990,000 bitcoins. At a minimum if each were interested only in one block of 3000 bitcoin this would work out at $59m or 99,000 bitcoins.

My tendency would be to put the estimate of this demand closer to the upper rather than the lower given the scale of the bidders involved (the Winklevoss twins purchased 1 million bitcoin in order to fund their ETF so we can likely expect that institutional investors are aiming to purchase a mere 3,000 for just $1.8m).

Institutional Investors

Demand on this scale seems to be easily enough to create a major price increase in bitcoin but this demand will likely not manifest in the same way as consumer demand.

Most large scale investors and all institutional investors will be aware of the effect their buying will have on the market. In such cases they will likely pursue every avenue for purchasing bitcoins (like the FBI auction or directly from large scale miners) before turning to an exchange. Doing so allows them to purchase large amounts of bitcoin without pushing up the price.

If they do buy on an exchange it may be via an algorithm or traders who will purchase in small amounts and may 'shake the tree' by selling larger portions of what they purchased to try and scare other traders into panic selling, creating a falling price that they can buy from. We probably won't see the same frenzied bandwagon of buying from these types of investors leading to an emotional surge in the price.

Bitcoin will not stay at the current price forever though and, particularly as the block reward halving approaches in 2017, these investors may be forced to turn to exchanges eventually to make their purchases (only one of the 40 bidders actually managed to buy the FBI bitcoins for example), at which point the demand could push up the price significantly.

It is also worth noting that any institutional investor that has already bought most of their quota may have an incentive to then buy the remainder from the markets precisely because it will push up the price. If they have the ability to move the market price of bitcoin with just the last portion of their investment then they can effectively create the gains which will make their original purchases look all the more astute to clients and push up the book value of their entire holding.

Most large scale investors and all institutional investors will be aware of the effect their buying will have on the market. In such cases they will likely pursue every avenue for purchasing bitcoins (like the FBI auction or directly from large scale miners) before turning to an exchange. Doing so allows them to purchase large amounts of bitcoin without pushing up the price.

If they do buy on an exchange it may be via an algorithm or traders who will purchase in small amounts and may 'shake the tree' by selling larger portions of what they purchased to try and scare other traders into panic selling, creating a falling price that they can buy from. We probably won't see the same frenzied bandwagon of buying from these types of investors leading to an emotional surge in the price.

Bitcoin will not stay at the current price forever though and, particularly as the block reward halving approaches in 2017, these investors may be forced to turn to exchanges eventually to make their purchases (only one of the 40 bidders actually managed to buy the FBI bitcoins for example), at which point the demand could push up the price significantly.

It is also worth noting that any institutional investor that has already bought most of their quota may have an incentive to then buy the remainder from the markets precisely because it will push up the price. If they have the ability to move the market price of bitcoin with just the last portion of their investment then they can effectively create the gains which will make their original purchases look all the more astute to clients and push up the book value of their entire holding.

Events

So far all the situations discussed amount to business as usual but there are many events that could lead to a surge in adoption and possibly also a surge in institutional investment.

Bitcoin back in 2013 was only available through a limited set of avenues such as exchanges. These exchanges had dubious reputations and ultimately you had to be quite committed to get through the difficulties to buy bitcoin. Now companies are building out large scale infrastructure to allow many more to purchase bitcoin. ATMs are popping up but on a larger scale 28,000 UK stores now offer bitcoin over the counter and 8,000 stores in Argentina started selling bitcoin as of August. Wallets used to be primarily available on PCs but now even full SPV wallets are available on both Android and iOS. PayPal has been making noises around bitcoin and likely can see that either they will need to incorporate bitcoin or risk being superceded by it. As this spreads and bitcoin becomes more available and more easily purchased we could easily see less linear and more exponential growth in adoption which could lead to an organic boost in the price. The thing to keep an eye on here would be the adoption rate of various wallets as the months go on.

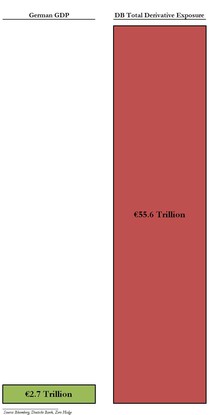

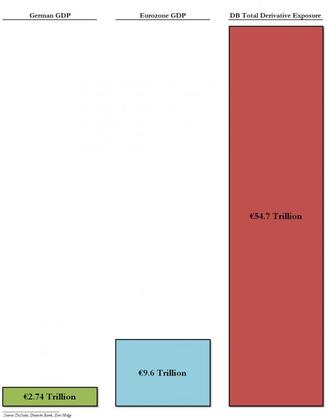

One event which could have a major impact is an event similar to the bank collapse in Cypris in 2013. Bail-in legislation (confiscation of deposits when a bank fails) has been put into place around the world an in particular in the EU and US. Although in the EU this legislation comes into force in 2018 it wasn't required for the Cypriot bail-in and in the event of another financial system crash it may not be required for bail-ins in the EU and US. Bank fraud has not been prosecuted and banks have even been deigned 'Too Big To Fail' which seems to have been translated into too big to prosecute / prevent from committing further fraud. Worse, banks are still leveraged in the extreme and appear to have very dubious valuations on their assets. In 2013 ZeroHedge reported Deutschebank to have around 1.6% assets and $72tn in exposure to derivatives. A year on in 2014 the situation is apparently the same:

Bitcoin back in 2013 was only available through a limited set of avenues such as exchanges. These exchanges had dubious reputations and ultimately you had to be quite committed to get through the difficulties to buy bitcoin. Now companies are building out large scale infrastructure to allow many more to purchase bitcoin. ATMs are popping up but on a larger scale 28,000 UK stores now offer bitcoin over the counter and 8,000 stores in Argentina started selling bitcoin as of August. Wallets used to be primarily available on PCs but now even full SPV wallets are available on both Android and iOS. PayPal has been making noises around bitcoin and likely can see that either they will need to incorporate bitcoin or risk being superceded by it. As this spreads and bitcoin becomes more available and more easily purchased we could easily see less linear and more exponential growth in adoption which could lead to an organic boost in the price. The thing to keep an eye on here would be the adoption rate of various wallets as the months go on.

One event which could have a major impact is an event similar to the bank collapse in Cypris in 2013. Bail-in legislation (confiscation of deposits when a bank fails) has been put into place around the world an in particular in the EU and US. Although in the EU this legislation comes into force in 2018 it wasn't required for the Cypriot bail-in and in the event of another financial system crash it may not be required for bail-ins in the EU and US. Bank fraud has not been prosecuted and banks have even been deigned 'Too Big To Fail' which seems to have been translated into too big to prosecute / prevent from committing further fraud. Worse, banks are still leveraged in the extreme and appear to have very dubious valuations on their assets. In 2013 ZeroHedge reported Deutschebank to have around 1.6% assets and $72tn in exposure to derivatives. A year on in 2014 the situation is apparently the same:

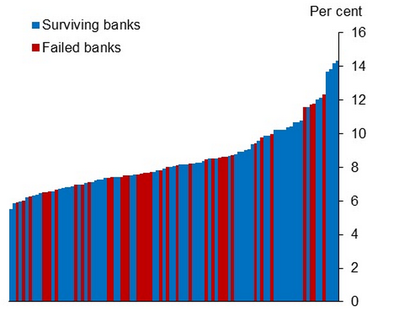

Further, Deutschebank appears to be just one bank among many that are in a similarly precarious situation. Bottomeuro's illuminating graphic shows that banks have failed throughout the range of capitalisation suggesting the recent Basel III push to capitalise banks better based on a 'risk weighted measure' is not helpful:

It doesn't seem a stretch to conclude that at some point in the next few years we will see another banking crash and may see a lot more of what occurred in Cyprus. If that does happen then bitcoin will be a safe haven that, due to the increased demand, will also be skyrocketing in value, creating the potential for a truly epic rise.

Generally speaking as bitcoin becomes better known and more accessible to people around the world it is better placed to take advantage of range of events such as bank failures, high inflation and national currency problems. It is not possible to predict these events but it is reasonable to say that the more reach bitcoin has, the more it will experience a surge from any one of these events.

Further developments in the pipeline such as building out remittances infrastructure based on bitcoin could lead to greatly increased demand over the next year or two and the Winklevoss ETF which could apparently be approved by the end of 2014 may also lead to a significant bump in demand. There are a lot of concurrent projects right now just getting started which may only really begin to kick in around 2015. As an example, Magnotti of Global Advisors Bitcoin Investment said some months ago that he had been 'flooded with requests to subscribe to his fund' and that his fund would only go live on the market in September (2014). It takes time for these projects to get their operations up and running and 2015 may be the year when they ramp up.

Generally speaking as bitcoin becomes better known and more accessible to people around the world it is better placed to take advantage of range of events such as bank failures, high inflation and national currency problems. It is not possible to predict these events but it is reasonable to say that the more reach bitcoin has, the more it will experience a surge from any one of these events.

Further developments in the pipeline such as building out remittances infrastructure based on bitcoin could lead to greatly increased demand over the next year or two and the Winklevoss ETF which could apparently be approved by the end of 2014 may also lead to a significant bump in demand. There are a lot of concurrent projects right now just getting started which may only really begin to kick in around 2015. As an example, Magnotti of Global Advisors Bitcoin Investment said some months ago that he had been 'flooded with requests to subscribe to his fund' and that his fund would only go live on the market in September (2014). It takes time for these projects to get their operations up and running and 2015 may be the year when they ramp up.

Lots of avenues, One outcome

All in all given the complexity of the bitcoin economy it is difficult in the extreme if not impossible to suggest a date and a price however given the bounded estimate, the trend for increased adoption and investment, and the variety of avenues for each it does seem reasonable that in 2015 and at the latest 2016 we could see significant growth in the price in the order that our original exponential price growth chart would predict. If this is the case then the chart may well work out predictive once more and might put us somewhere in the range of $3k to $10k by the end of 2015.

RSS Feed

RSS Feed