Alternatives to bitcoin have been around almost as long as bitcoin itself. Since bitcoin is open source anyone can take the code, make a few minor or major changes and start their own alt-coin with its own block chain.

Given this it might seem that bitcoin itself has no value. It may be impossible to produce more bitcoins thereby making the currency itself deflationary but the production of other cryptocurrencies with their own blockchains that can essentially fulfil the same job and have all the same benefits might dilute bitcoin's share of the cryptocurrency market?

Given this it might seem that bitcoin itself has no value. It may be impossible to produce more bitcoins thereby making the currency itself deflationary but the production of other cryptocurrencies with their own blockchains that can essentially fulfil the same job and have all the same benefits might dilute bitcoin's share of the cryptocurrency market?

The bitcoin snowball

The problem with this viewpoint is it entirely discounts the role that momentum plays in the use of cryptocurrencies. Litecoin may be technically able to operate in the same way as bitcoin and may even have a few minor advantages like the faster transaction confirmations but bitcoin is what people hear about first and judging on a variety of metrics it is what they will consider to be the 'primary' cryptocurrency.

This initial momentum has propelled bitcoin far further than any alt-coin. Infrastructure is growing around bitcoin-only services in a way that alt-coins can only dream of. Merchants and blogs accept bitcoin but not litecoin, the finance industry is creating funds around only bitcoin, mobile apps are being developed purely for bitcoin. Even the main exchanges trade only bitcoin. This growing infrastructure feeds the price of bitcoin which further widens the gap and helps to cement bitcoin's position at the top.

This initial momentum has propelled bitcoin far further than any alt-coin. Infrastructure is growing around bitcoin-only services in a way that alt-coins can only dream of. Merchants and blogs accept bitcoin but not litecoin, the finance industry is creating funds around only bitcoin, mobile apps are being developed purely for bitcoin. Even the main exchanges trade only bitcoin. This growing infrastructure feeds the price of bitcoin which further widens the gap and helps to cement bitcoin's position at the top.

Alt-Coins must bring New benefits

For anyone choosing to buy a bitcoin or a bunch of alt-coins, their decision will have to be backed by a judgement of the value of each. For them to choose bitcoin is pretty straightforward - they can spend bitcoins online, they see bitcoin's value going up, bitcoins are in the news, there are bitcoin apps and they can transact with others that have them.

Choosing an alt-coin would imply that there is some benefit to the alt-coin over the bitcoin but alt-coins generally introduce no improvements to the bitcoin protocol and instead make simple tweaks like changing the hashing algorithm, claiming that it is better in some way than SHA-256, or tweaking other numbers like the confirmation time.

These efforts are minor and introduce no substantive benefit over bitcoin, so the decision is really down to which one is more widely accepted and/or has the best potential to make gains (if bought for speculation).

Choosing an alt-coin would imply that there is some benefit to the alt-coin over the bitcoin but alt-coins generally introduce no improvements to the bitcoin protocol and instead make simple tweaks like changing the hashing algorithm, claiming that it is better in some way than SHA-256, or tweaking other numbers like the confirmation time.

These efforts are minor and introduce no substantive benefit over bitcoin, so the decision is really down to which one is more widely accepted and/or has the best potential to make gains (if bought for speculation).

room for any alt-coins?

Alt-coins then that are nothing more than a tweaked carbon copy of bitcoin don't appear to have a rosy future. But in the same way that Facebook started later and overtook MySpace and Friendster despite their momentum to become by far the dominant social network, it doesn't mean that bitcoin is unchallengeable.

What it does mean is that an alt-coin will have to replicate the advantages that bitcoin already has.

In terms of the infrastructure this will mean:

What it does mean is that an alt-coin will have to replicate the advantages that bitcoin already has.

In terms of the infrastructure this will mean:

- Duplicating (and maybe improving) mobile apps across multiple devices

- Creating an exchange system worldwide to allow people to easily swap fiat currencies to and from the coin

- Publicising it / providing it with backing equal to the wide range that bitcoin has currently.

- Somehow providing a secure hashing network

Will a CorporateCoin win out in the end?

Such a currency isn't going to appear by someone altering a hash method in the bitcoin code and then uploading the software to a website.

If it comes from anywhere it will come from one or more well financed corporations. Such a corporation could start their own coin, provide it with a lot of hashing power (perhaps centrally located initially but given enough cash and a well chosen hashing algorithm they could entice enough people in to build a critical mass of miners), create slick mobile and desktop apps to use it, provide exchange facilities both over the internet and maybe also on the ground via shops etc.

If orchestrated well enough and sold hard enough it could be seen as a viable alternative to bitcoin or even pushed as bitcoin's "successor".

Even given this play though there are some hurdles that won't be easy to overcome.

Firstly, any developments that feature in the new coin may well be portable to bitcoin, meaning that bitcoin can update, pick up the improvements and carry on with all its entrenched users and infrastructure, leaving the alt-coin with no technical advantage.

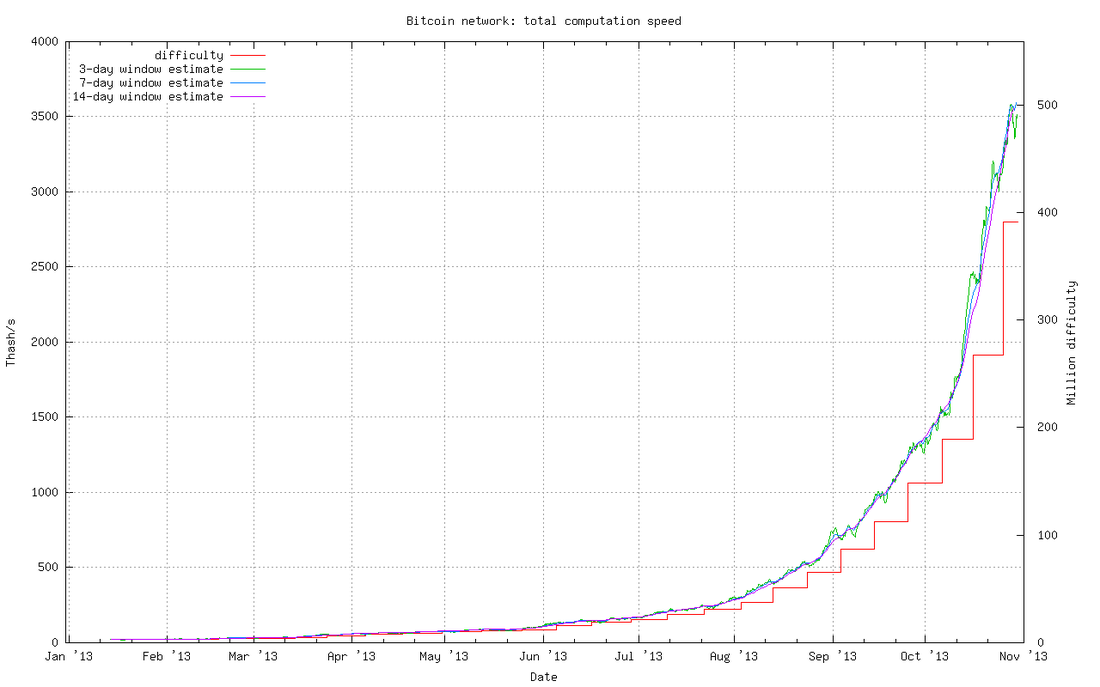

Next, the hashing power of the mining network is crucial in securing it. The higher the difficulty to find a block, the more difficult it is to attack the network and therefore the more secure it is. In the earlier half of 2013 bitcoin's mining network was made up of graphics cards and ASICs were just starting to get going. At such a stage it might have been possible for a corporation to provide a viable alternative but as ASICs have taken off so has the hashing power and difficulty and now replicating the bitcoin network would be a very difficult and expensive task indeed. In addition, the hashing power of bitcoin is distributed and therefore safe from manipulation whereas a competitor would almost certainly have to be centralised as least to begin with putting it at a disadvantage.

If it comes from anywhere it will come from one or more well financed corporations. Such a corporation could start their own coin, provide it with a lot of hashing power (perhaps centrally located initially but given enough cash and a well chosen hashing algorithm they could entice enough people in to build a critical mass of miners), create slick mobile and desktop apps to use it, provide exchange facilities both over the internet and maybe also on the ground via shops etc.

If orchestrated well enough and sold hard enough it could be seen as a viable alternative to bitcoin or even pushed as bitcoin's "successor".

Even given this play though there are some hurdles that won't be easy to overcome.

Firstly, any developments that feature in the new coin may well be portable to bitcoin, meaning that bitcoin can update, pick up the improvements and carry on with all its entrenched users and infrastructure, leaving the alt-coin with no technical advantage.

Next, the hashing power of the mining network is crucial in securing it. The higher the difficulty to find a block, the more difficult it is to attack the network and therefore the more secure it is. In the earlier half of 2013 bitcoin's mining network was made up of graphics cards and ASICs were just starting to get going. At such a stage it might have been possible for a corporation to provide a viable alternative but as ASICs have taken off so has the hashing power and difficulty and now replicating the bitcoin network would be a very difficult and expensive task indeed. In addition, the hashing power of bitcoin is distributed and therefore safe from manipulation whereas a competitor would almost certainly have to be centralised as least to begin with putting it at a disadvantage.

Lastly, and particularly with centralised hashing power, any such alt-coin would be seen as being under the control of the organisation, much like Ripple. Its difficult to judge how many people out of the worlds population would care about the coin being under the control of an organisation rather than decentralised but decentralisation is a core concept of bitcoin. Most people may not care but more tech-savvy users will. In order to get around this the currency would have to fight technical users and appeal direct to end users. This may be feasible with the right marketing effort but it is an avenue for strong criticism which is not available for bitcoin and therefore yet another disadvantage.

Alt-Coin motivations

There are a lot of organisations that might be a good candidate in terms of their ability to start a CorporateCoin; Banks, Western Union, large end-user focused multinationals like Amazon, but one key question remains: what would their motivation be?

For small time alt-coiners the motivation is in most cases quite apparent, when we see stories in the news about someone buying 5,000 bitcoins for $25 and then using some of their new $850,000 value to buy an apartment when he remembered them a year or two later there is no doubt a strong feeling of envy and a desire to replicate the same conditions only with you as the early adopter. If this is the only motivation for the alt-coin though it is doomed to fail.

For a corporation the motivation is less clear, although a corporation could have the same motivation (to place themselves as an early adopter - again like Ripple) to pose a real challenge to bitcoin would require a large investment and it would amount to no more than a risky gamble that gets more difficult to pull off with each passing day.

Whether an alt-coin will appear that really introduces something significant enough to make a dent in bitcoin is anybody's guess but the currently available alternatives aren't the ones to do the job.

For small time alt-coiners the motivation is in most cases quite apparent, when we see stories in the news about someone buying 5,000 bitcoins for $25 and then using some of their new $850,000 value to buy an apartment when he remembered them a year or two later there is no doubt a strong feeling of envy and a desire to replicate the same conditions only with you as the early adopter. If this is the only motivation for the alt-coin though it is doomed to fail.

For a corporation the motivation is less clear, although a corporation could have the same motivation (to place themselves as an early adopter - again like Ripple) to pose a real challenge to bitcoin would require a large investment and it would amount to no more than a risky gamble that gets more difficult to pull off with each passing day.

Whether an alt-coin will appear that really introduces something significant enough to make a dent in bitcoin is anybody's guess but the currently available alternatives aren't the ones to do the job.

RSS Feed

RSS Feed